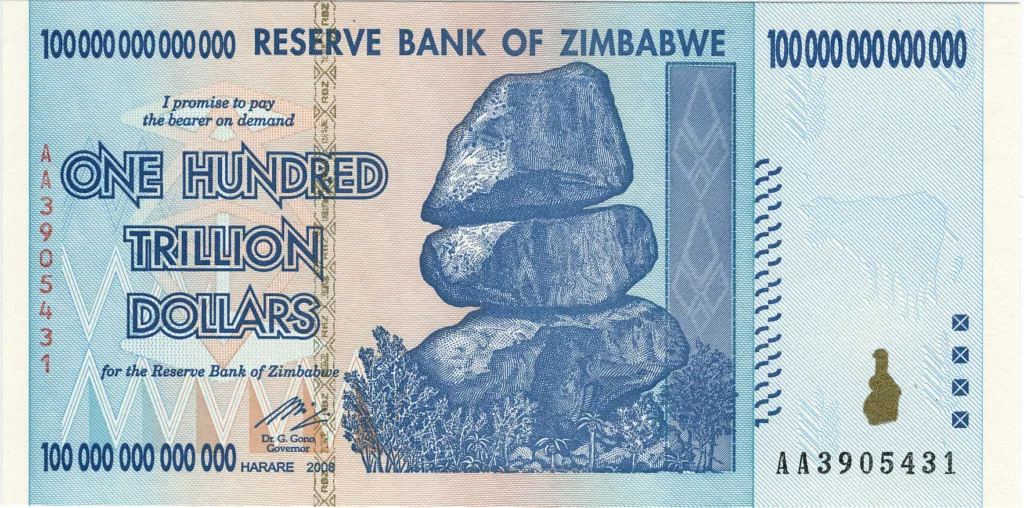

Zimbabwe has introduced a new currency, the Zimbabwe Gold (ZiG), which will act as legal tender for everyday transactions. The currency is not based on blockchain; instead, Zimbabweans can purchase ZiG through commercial banks, with each milligram of gold (the backing asset for ZiG) worth about six cents. This move follows a turbulent economic history for Zimbabwe, which has faced hyperinflation, causing many to lose trust in its central bank. The country had previously discontinued its national currency, ZWD, in 2009 due to hyperinflation.

Several reasons are cited for Zimbabwe’s economic challenges: the controversial land reforms of 2000, trade sanctions, and under-reported war spending during the Second Congo War. The introduction of ZiG might be seen as a step towards re-establishing the central bank’s authority, but some see it as an attempt at de-dollarization. Critics argue that without blockchain, there’s no verifiable way to determine how many ZiGs have been issued, and the fact that it’s pegged to gold doesn’t limit the potential for its misuse.

The crux of the issue is trust and transparency. Digital currencies like bitcoin offer full visibility of transactions and holdings, an unprecedented feature in the monetary world. If Zimbabwe’s goal is to establish a robust national currency, radical transparency could be the answer. The ultimate solution lies in addressing the root economic problems and establishing good monetary management rather than opting for short-term solutions like ZiG. The current approach seems to cater more to external interests than a genuine attempt to restore monetary stability.