On 11 October, Santiment highlighted a recent crypto market price correction through a tweet. During this time, Bitcoin remained steady without significant movement.

In contrast, cryptocurrencies such as XMR and RNDR exhibited notable growth, boasting gains exceeding 3% and 4%, respectively.

According to CoinMarketCap, XMR’s price had a slight change in the past 24 hours and was valued at $151.86 at the point of reporting. Its market cap exceeded $2.7 billion, ranking it as the 24th largest cryptocurrency.

Alongside the increase in Monero’s price was a rise in its trading volume – a typical precursor to a bullish trend. The past week witnessed increased price volatility for Monero, attributed to the price boost.

📊 Most market caps in #crypto have experienced mild corrections over the past week. However, #Bitcoin has stayed flat at the $27.4K level. The few standouts over the past week include $XMR (+3.7%) and $RNDR (+4.5%). $BTC maximalists historically thrive under these conditions. pic.twitter.com/czvFn1A6Ql

— Santiment (@santimentfeed) October 10, 2023

However, in the derivatives market, the demand for XMR decreased, evidenced by its mostly red Binance funding rate over the past week.

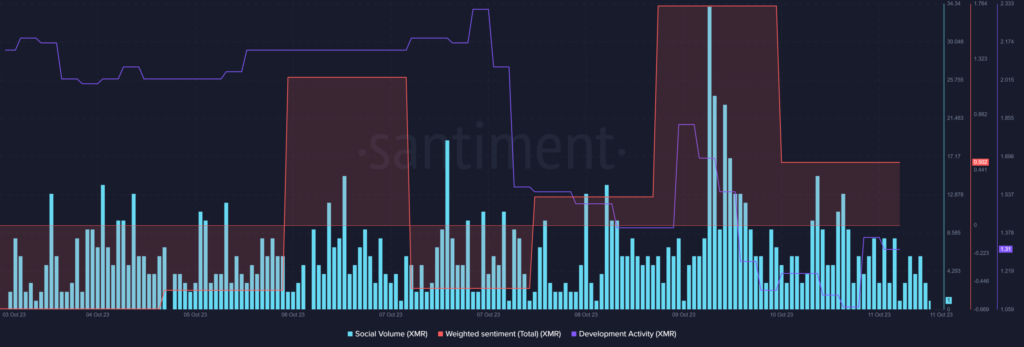

As Monero’s price escalated, the crypto community’s chatter around it grew, demonstrated by an increase in its Social Volume.

Monero’s sentiment score indicated a market leaning more towards positivity regarding the coin. Yet, while its price surged, the Development Activity for XMR saw a decline.

Monero’s Future Outlook

Despite investors reaping profits recently, further analysis suggests this trend might persist. Data from LunarCrush highlighted several optimistic metrics for Monero.

For example, over the previous week, Monero’s Altrank saw significant improvement. The bullish sentiment related to the coin also experienced a surge, indicating high investor confidence in its continued rally.

However, an examination of Monero’s daily chart revealed that its Chaikin Money Flow (CMF) showed positive signs, but some indicators hinted at potential bearish tendencies. The Relative Strength Index (RSI) descended towards the neutral 50 mark, and the MACD hinted at a possible bearish shift in the near future.