Cryptocurrency has emerged as one of the most transformative technological innovations of the 21st century. In a world increasingly driven by digitalization, cryptocurrencies have revolutionized the way we perceive and conduct financial transactions. This article explores the fascinating world of cryptocurrency in-depth, delving into its history, technology, impact on various sectors, regulatory challenges, and the future it holds for the global economy.

A Brief History of Cryptocurrency

To understand the significance of cryptocurrency, we must begin with its origins. The concept of digital currency dates back to the 1980s, but it wasn’t until 2009 that Bitcoin, the first decentralized cryptocurrency, was introduced by an anonymous entity or group known as Satoshi Nakamoto. Bitcoin’s whitepaper, titled “Bitcoin: A Peer-to-Peer Electronic Cash System,” outlined a revolutionary idea – a digital currency that could operate without the need for a central authority like banks or governments.

Bitcoin’s success led to the proliferation of other cryptocurrencies, commonly referred to as altcoins, such as Ethereum, Ripple, and Litecoin. These digital currencies introduced innovations like smart contracts and faster transaction times, further expanding the possibilities of blockchain technology.

The Technology Behind Cryptocurrency: Blockchain

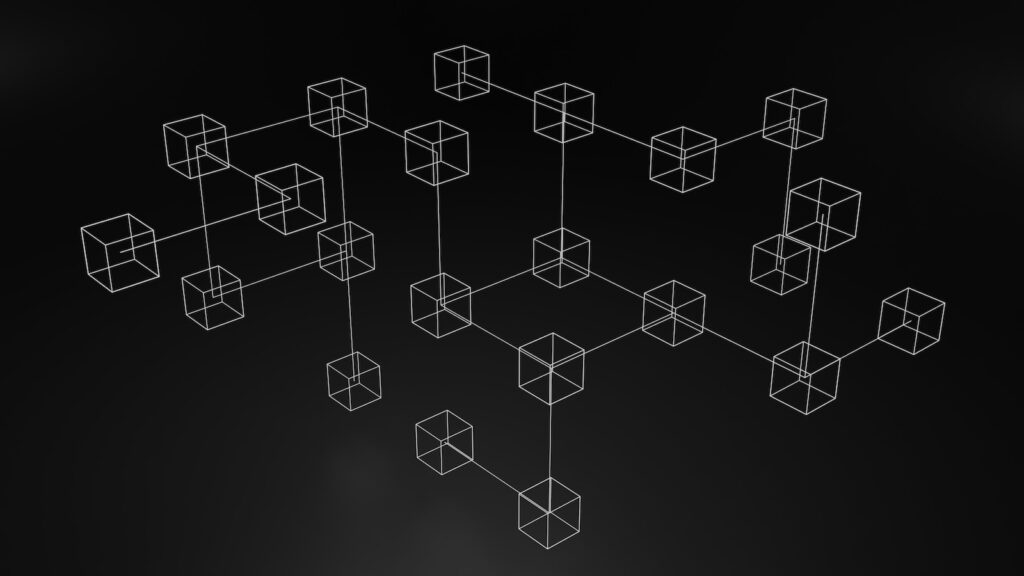

At the heart of cryptocurrencies lies blockchain technology. A blockchain is a decentralized ledger that records all transactions across a network of computers. This ledger is immutable, transparent, and secure, making it a groundbreaking innovation in the world of finance. Let’s explore the key features of blockchain:

- Decentralization: Unlike traditional financial systems where a central authority oversees transactions, blockchains are maintained by a network of nodes (computers) spread worldwide. This decentralization reduces the risk of manipulation and fraud.

- Transparency: All transactions are recorded on a public ledger, accessible to anyone. This transparency helps build trust among users and ensures the integrity of the system.

- Security: Cryptography ensures the security of transactions, making it extremely difficult for unauthorized parties to alter the data within a blockchain.

- Immutability: Once a transaction is added to the blockchain, it cannot be altered or deleted. This immutability ensures a permanent and tamper-proof record of all transactions.

Cryptocurrency Applications

Cryptocurrencies have gone beyond being just digital cash; they have found applications in various sectors:

- Digital Payments: Cryptocurrencies offer a borderless, low-cost solution for cross-border transactions, making international remittances more accessible and affordable.

- Investment: Many individuals and institutions view cryptocurrencies as an alternative investment class, akin to gold or stocks. The potential for high returns has attracted investors worldwide.

- Smart Contracts: Ethereum introduced the concept of smart contracts, self-executing agreements with the terms of the contract directly written into code. These contracts automate complex tasks, reducing the need for intermediaries.

- Tokenization: Assets such as real estate, art, and even stocks can be tokenized and represented as digital assets on a blockchain, increasing accessibility and liquidity.

- Decentralized Finance (DeFi): DeFi platforms leverage blockchain technology to create financial services like lending, borrowing, and trading without traditional intermediaries, such as banks.

- Non-Fungible Tokens (NFTs): NFTs are unique digital assets representing ownership of digital or physical items like art, collectibles, and even tweets. They have gained immense popularity in the art and entertainment industries.

- Supply Chain Management: Cryptocurrencies and blockchain technology can be used to track the provenance and authenticity of products throughout the supply chain, reducing counterfeiting and ensuring product quality.

Cryptocurrency’s Impact on Finance

The rapid rise of cryptocurrency has had a profound impact on the financial landscape:

- Financial Inclusion: Cryptocurrencies provide financial services to the unbanked and underbanked populations worldwide, giving them access to banking, savings, and investment opportunities.

- Reduced Transaction Costs: Traditional financial institutions often charge substantial fees for cross-border transfers. Cryptocurrencies offer a cost-effective alternative, especially for remittances.

- Disruption of Traditional Banking: Cryptocurrencies challenge the traditional banking system by providing a decentralized and trustless way to store and transfer value. This has prompted banks to explore blockchain technology and digital currencies.

- Asset Diversification: Investors now have a new asset class to diversify their portfolios, potentially offering higher returns than traditional investments.

- Financial Innovation: The cryptocurrency space has fostered innovation, including the development of new financial products, services, and investment strategies.

Challenges and Concerns

While cryptocurrencies offer numerous benefits, they are not without their challenges and concerns:

- Regulatory Uncertainty: Governments worldwide are grappling with how to regulate cryptocurrencies. Concerns about money laundering, tax evasion, and consumer protection have led to varying regulatory approaches.

- Volatility: The prices of cryptocurrencies can be extremely volatile, making them risky investments and hindering their adoption as stable forms of currency.

- Security Risks: Hacks and fraud are constant threats in the cryptocurrency space. Secure storage solutions, such as hardware wallets, are essential to protect digital assets.

- Environmental Concerns: Many cryptocurrencies, including Bitcoin, consume significant energy in the mining process. This has led to concerns about their environmental impact.

- Scalability: As cryptocurrencies gain popularity, they must address scalability issues to handle a growing number of transactions efficiently.

The Future of Cryptocurrency

The future of cryptocurrency is both promising and uncertain:

- Mainstream Adoption: As cryptocurrencies become more widely accepted and integrated into traditional financial systems, their use in everyday transactions may become commonplace.

- Central Bank Digital Currencies (CBDCs): Many central banks are exploring the development of their digital currencies, potentially integrating them with existing cryptocurrencies or blockchain technology.

- Technological Advancements: Ongoing innovations in blockchain technology, such as sharding and proof-of-stake, could improve scalability and reduce energy consumption.

- Regulation and Compliance: Increased regulatory clarity may lead to a more stable and secure cryptocurrency market, encouraging institutional investors to participate.

- Integration with Other Technologies: Cryptocurrencies may intersect with emerging technologies like artificial intelligence, the Internet of Things (IoT), and 5G networks, opening new possibilities for their application.

Conclusion

Cryptocurrency has emerged as a transformative force in the world of finance, challenging traditional systems and opening new avenues for innovation and financial inclusion. While challenges and concerns persist, the potential benefits of cryptocurrencies are too significant to ignore. As the technology continues to evolve and adapt to regulatory changes, its impact on the global economy is likely to grow, ushering in a new era of digital finance.