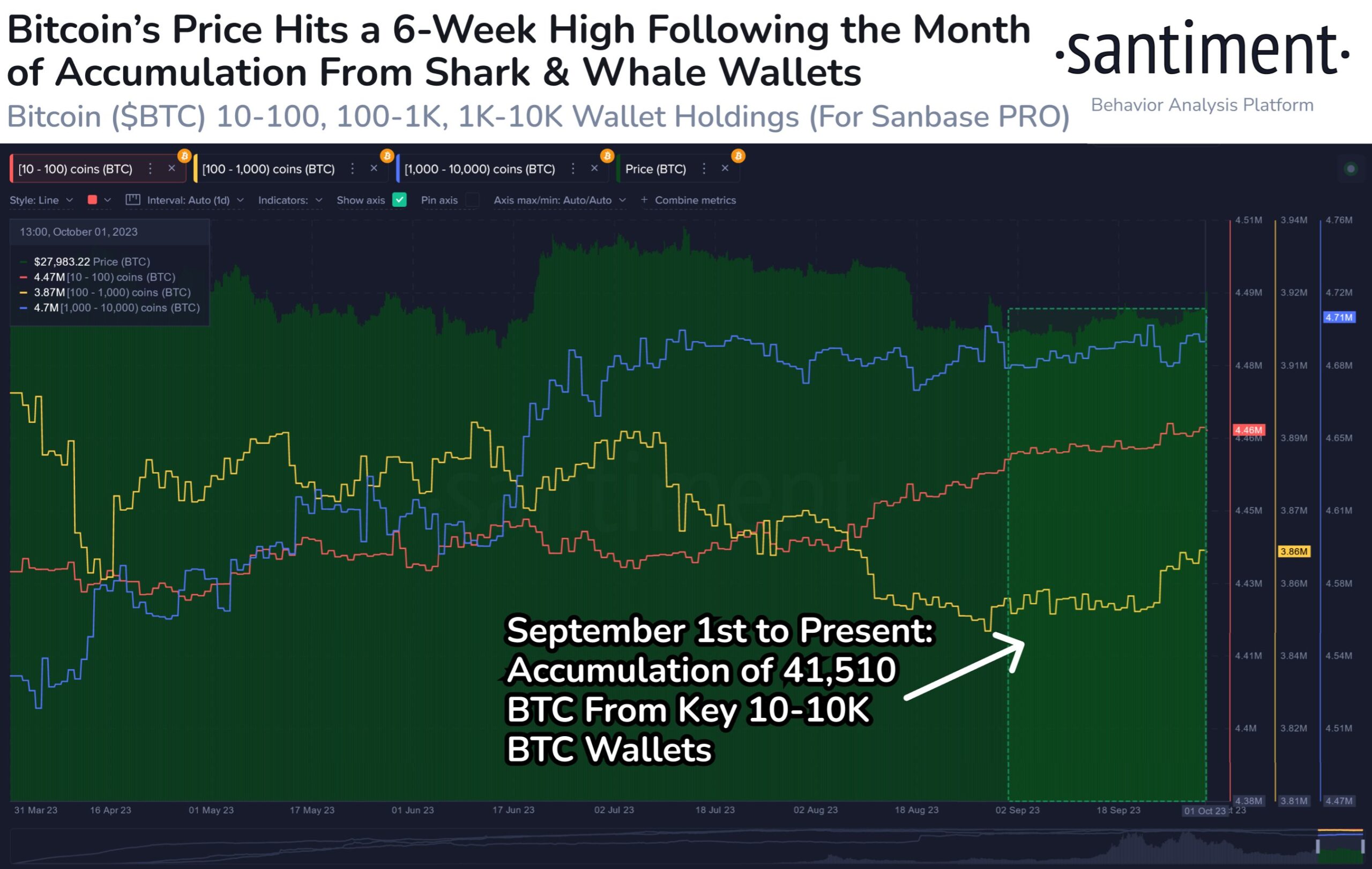

Bitcoin has recently surpassed the $28,000 mark, spurred by significant accumulation activities from large BTC holders. Data from the on-chain analytics firm Santiment reveals that these prominent Bitcoin wallets, segmented by their holdings, have collectively added $1.17 billion in the cryptocurrency over the past month. These investor segments include:

- Whales: Investors holding between 1,000 and 10,000 BTC.

- Sharks: Those holding between 100 and 1,000 BTC.

- Smaller yet significant holders: Investors with 10 to 100 BTC.

Recent data trends show all three groups have increased their Bitcoin holdings in the past six months, despite the cryptocurrency’s volatile pricing. Their continued accumulation seems to be a potential factor in Bitcoin’s recent price surge.

🐳 #Bitcoin has blasted back above $28K for the first time since August 17th. With 10-10K $BTC wallets accumulating a combined $1.17B since September 1st, a return to a $30K market value looks more and more likely unless these wallets now start dumping. https://t.co/sdcPWGiBMg pic.twitter.com/zN741HmDqh

— Santiment (@santimentfeed) October 2, 2023

After enduring a period of price stagnation, Bitcoin has now experienced a sharp uptick, reaching a value not observed since mid-August. There’s growing anticipation in the market that Bitcoin might approach the $30,000 milestone. However, the continued upward trajectory could be influenced by whether these major investors decide to sell and realize their gains.

As of now, these significant stakeholders have not initiated any major sell-offs. Yet, the market remains watchful, understanding that the actions of these ‘sharks’ and ‘whales’ in the coming days could dictate Bitcoin’s next major price move.