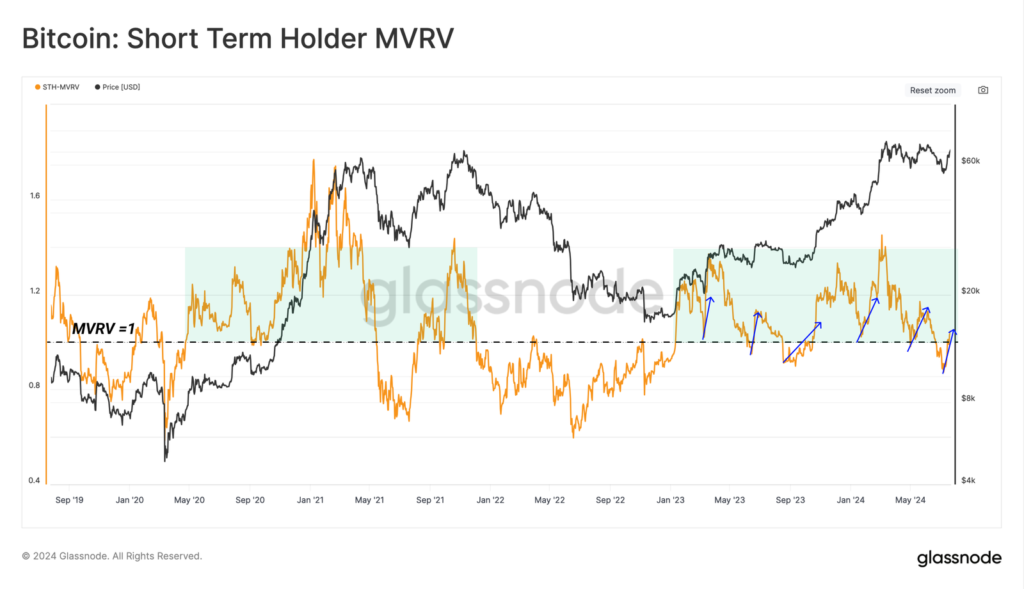

Bitcoin’s recent price surge has brought significant relief to short-term holders, with three-quarters now turning profitable. This positive shift follows a detailed analysis by Glassnode, highlighting Bitcoin’s upward momentum as of July 24.

During late July, over 90% of the supply held by short-term investors was in the red. The recent rally has alleviated these losses, showcasing the changing dynamics within the Bitcoin market. Short-term holders are often seen as a barometer for gauging Bitcoin demand and recent buying trends, and the current profitability suggests renewed interest and positive sentiment.

“This rally has now broken back above the STH cost basis and returned 75% of their held supply to an unrealized profit. This can be seen within the STH-MVRV metric, which has now recovered above the break-even level of 1.0.”

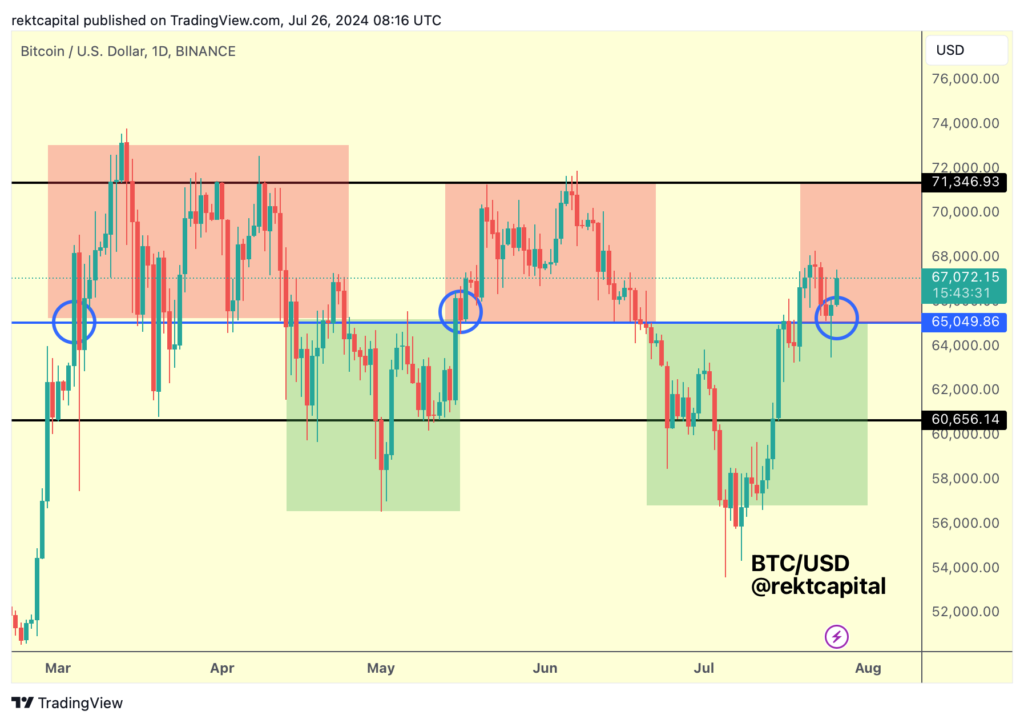

Bitcoin’s price has successfully maintained above a crucial support level, despite the looming expiration of $3.9 billion in BTC futures contracts, which had the potential to push the price down to $63,000. Crypto analyst Rekt Capital, in a July 26 post on X, emphasized the importance of Bitcoin staying above the $65,000 mark to maintain its bullish trajectory.

“The retest was successful. Bitcoin has confirmed $65,000 as support. Price will now continue to occupy the $65000-$71500 region (red).”

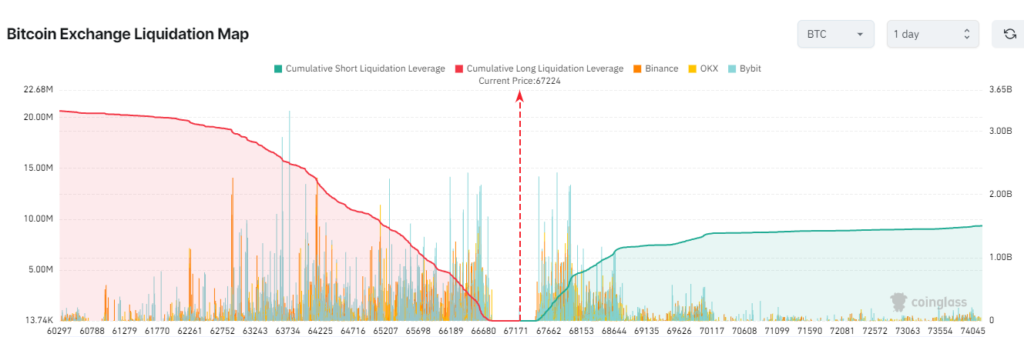

However, Bitcoin faces substantial resistance at the $68,000 level. This psychological barrier is reinforced by nearly $700 million in cumulative leveraged short positions across various exchanges. Should Bitcoin surpass $68,000, these short positions could be liquidated, potentially driving the price even higher. CoinGlass data suggests that short liquidations could exceed $1 billion if Bitcoin reaches above $68,500, though this would likely depend on the inflow dynamics from US spot Bitcoin exchange-traded funds (ETFs).

Interestingly, inflows into these US spot Bitcoin ETFs have been slowing since July 23, with cumulative inflows reaching $31.1 million by July 25, according to Farside Investors data. This deceleration in ETF inflows could influence Bitcoin’s ability to break through the $68,000 resistance level in the near term.

In conclusion, while Bitcoin’s recent rally has brought much-needed relief to short-term holders, the cryptocurrency still faces significant resistance. The interplay between futures expiry, ETF inflows, and market sentiment will be critical in determining Bitcoin’s price trajectory in the coming weeks.